michigan use tax exemptions

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Streamlined Sales and Use Tax Project.

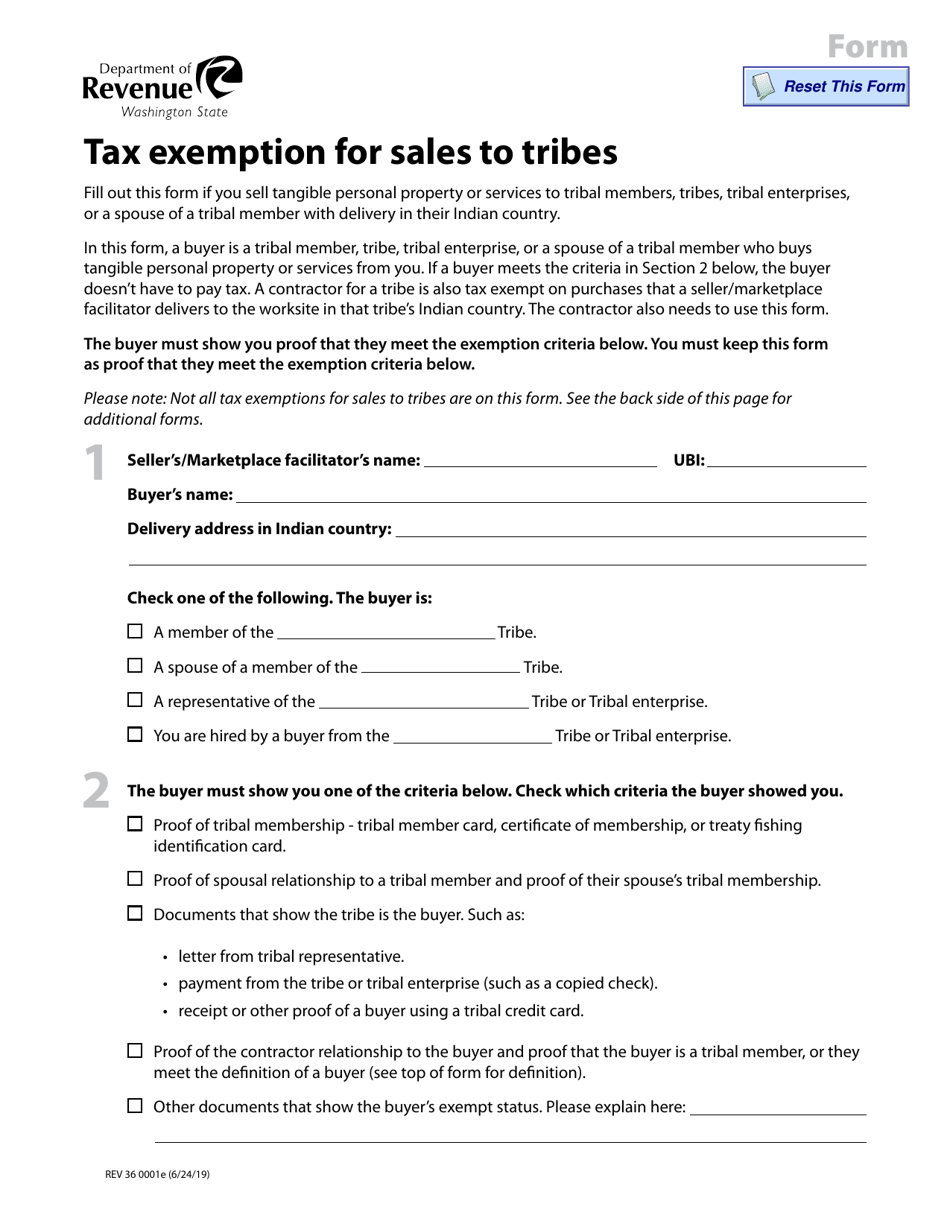

Form Rev36 0001e Download Fillable Pdf Or Fill Online Tax Exemption For Sales To Tribes Washington Templateroller

There are no local sales taxes in the state of Michigan.

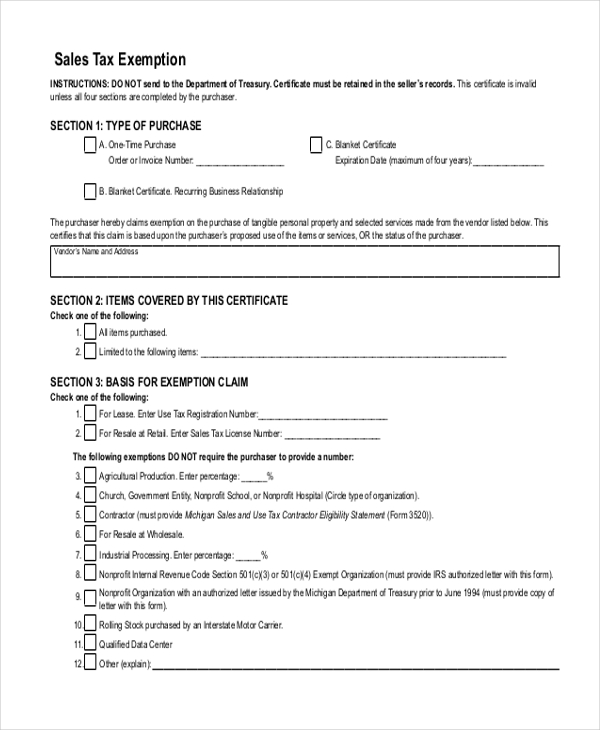

. This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. Department of Treasury holding that the Michigan Use Tax apportionment rules apply in situations where property is simultaneously used for exempt and non-exempt purposes. Do not send a copy to Treasury unless one is requested.

F Purchase price or price means the total amount of. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. 01-21 Michigan Sales and Use Tax Certificate of Exemption. It is important to note that tax-exempt status.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet by mail or by phone from out-of-state retailers that do not collect and remit sales or use tax from their. What is Exempt From Sales Tax in Michigan. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

Notice of New Sales Tax Requirements for Out-of-State Sellers. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. This is a use tax registration.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372. 20591 Use tax act. This page discusses various sales tax exemptions in Michigan.

Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your tax-exempt status. The People of the State of Michigan enact. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. 20 Out-of-State Sales -.

Printable Michigan Sales and Use Tax Certificate of Exemption Form 3372 for making sales tax free purchases in Michigan. All claims are subject to audit. Michigan Sales Tax Exemptions.

How to use sales tax exemption certificates in Michigan. History1937 Act 94 Eff. Use tax is a companion tax to sales tax.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. 18 Merchandise - Sale of merchandise such as calendars plants jewelry blankets and CDs are subject to tax.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. Prescription medications and prescription eyeglasses are not taxable.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals. Several examples of exemptions to the states.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. All claims are subject to audit. From the tax levied under this act to a use not exempt from the tax levied under this act.

Michigan Department of Treasury 3372 Rev. This form can be found on the Michigan Department of Treasurys website. The manufacturer will fill out and send in one form for each of their qualifying vendors.

This act may be cited as the Use Tax Act. All claims are subject to audit. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be.

Use tax is also collected on the consumption use or storage of goods in Michigan if sales tax. Michigans use tax rate is six percent. Thursday June 10 2021.

The apportionment language DTE relied upon is present in other use tax exemptions for other industries as well including producers of agricultural products wholesalers. 19 Online Sales - Sales delivered within Michigan are subject to Michigan sales tax. Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form 3372.

For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit housing organization from property taxes for a maximum period of five years if the property is intended for ultimate occupancy by low-income persons as a principal residence. Sales Tax Exemptions in Michigan.

Sales And Use Tax Regulations Article 3

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Small Business Guide Truic

Download Policy Brief Template 40 Brief Executive Summary Ms Word

10 Ways To Be Tax Exempt Howstuffworks

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

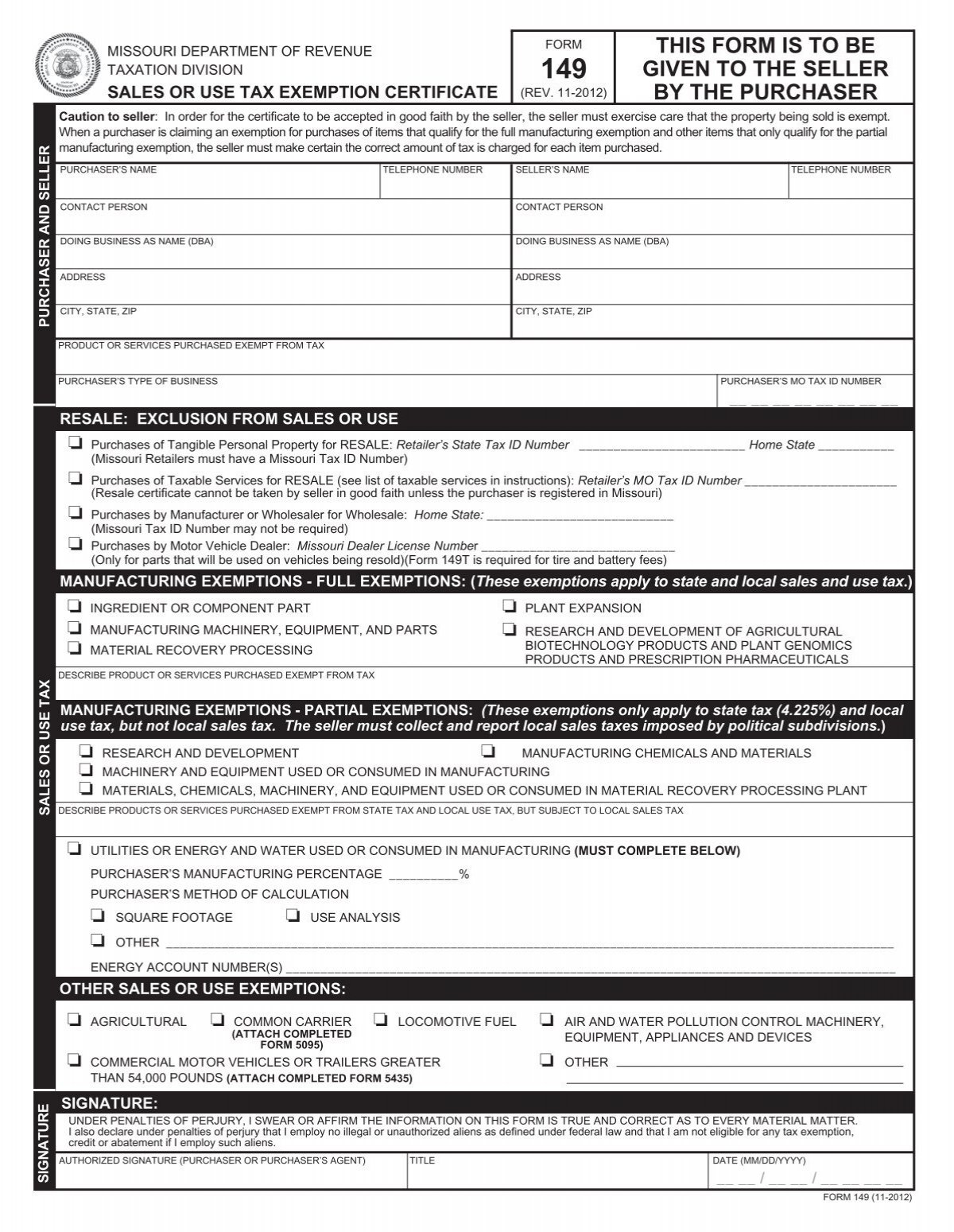

Form 149 Sales And Use Tax Exemption Certificate Missouri

Michigan Sales Tax Exemptions Agile Consulting Group

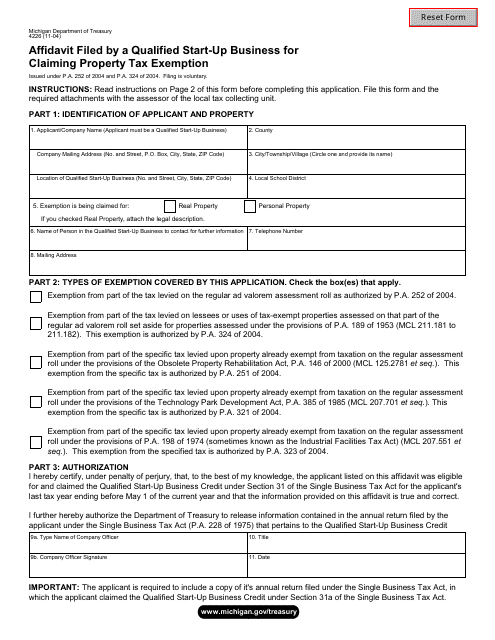

Form 4226 Download Fillable Pdf Or Fill Online Affidavit Filed By A Qualified Start Up Business For Claiming Property Tax Exemption Michigan Templateroller

Michigan Sales Tax Exemptions Agile Consulting Group

Requirements For Tax Exemption Tax Exempt Organizations

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Credits